VAT in UAE 1.0.7

Continue to app

Free Version

Publisher Description

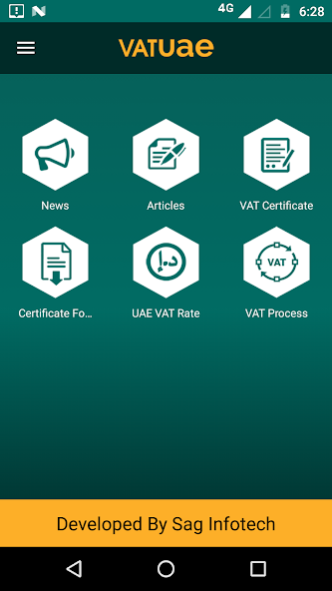

VAT (Value Added Tax) will be implemented in United Arab Emirates, Saudi Arabia, Bahrain, Kuwait, Oman and Qatar from 1 Jan 2018. For which, SAG Infotech has developed VAT Helpline app, which is an ultimate tool for all getting knowledge about VAT UAE and related latest VAT news, VAT articles, VAT Draft bill along with UAE VAT rates and their applicability for sectors, frequently asked questions on VAT and some important links administered by the UAE ministry of finance have also been included in the application. The VAT helpline app is available in Arabic, English, Persian, Urdu, Hindi, Kuwaiti and Arabic languages, which offers a wide range of features and information regarding the VAT impact and effects in UAE in a feasible way. Our dedicated team is trying their level best to offer the users best experience. We welcome and appreciate your valuable feedback which lets us make significant improvements in the future.

The VAT is believed to be a great move by the UAE Government and we are offering best VAT app for business professionals. VAT helpline also offers VAT guide, which provides you complete appropriate knowledge over the upcoming VAT act in the country. Our motive of developing a VAT app is to share information and keep people updated regarding the new taxation regime. Our VAT software also provides you access to the VAT portal and is blessed with a very simple and responsive design language and features a wide range of VAT information links and VAT rules.

Application Features:

1. VAT News- This section offers regular updates on VAT news and keeps the users notified about the latest happening in the VAT. It features all trending VAT news. The notification feature notifies the users automatically whenever any news gets published. The user can easily read the news by tapping the notification.

2. VAT Articles- This section brings you in-depth details and opinion regarding VAT UAE. The articles are published under the guidance of qualified CA and CS who hold a better understanding of the VAT and Tax industry. The app also allows the guest users to post their opinions on the VAT UAE.

3. VAT Forms- The Government released official forms related to the VAT can be easily found in this section for VAT enrollment. You can also go through the e-copy of the VAT forms available in the app for e-filing of VAT. The forms module will be required to be filled by all taxpayers in India under the new tax scheme. The users get to know more about the VAT registration and return process.

4. VAT Calculator- The VAT calculator lets the users calculate their taxes. The VAT calculation can be done by filling the VAT rate and providing the applicable rates as input.

6. Final Rates- This section reveals the VAT rates proposed for UAE i.e. 3% - 5%. The goods will be included under these mentions VAT rates after the implementation of the VAT Law in UAE.

7. VAT Law and FAQs- This section provides you basic details of the VAT UAE through FAQs. The VAT law reveals the VAT structure of the new tax scheme. The VAT FAQs consists of various questions on different aspects of VAT in UAE.

8. Guest Post- This section allows you to share your views and thoughts regarding the upcoming tax regime in UAE.

About VAT in UAE

VAT in UAE is a free app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops VAT in UAE is SAG INFOTECH PVT LTD. The latest version released by its developer is 1.0.7.

To install VAT in UAE on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2017-09-15 and was downloaded 1 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the VAT in UAE as malware as malware if the download link to com.sag.vat is broken.

How to install VAT in UAE on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the VAT in UAE is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by VAT in UAE will be shown. Click on Accept to continue the process.

- VAT in UAE will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.